By: Ford Donohue

06/21/2019

For months headlines have been dominated by the US China Trade War. As an investor, it’s easy to get caught up in the day to day swings in the market; but we believe that it’s important to take a step back, understand the drivers behind the US-China trade tensions, and make decisions that put portfolios in the best position for long-term growth.

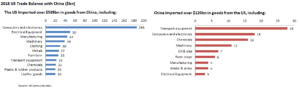

There are two main factors driving the trade war between the US and China: the large bilateral trade deficit and China’s lack of protection for US Tech Intellectual Property (“IP”). As an example of the first factor, the US imports roughly $540bn in goods from China on an annual basis, while China imports just $120bn worth of goods from the US. As an example of the second factor, China often forces US tech companies to divulge proprietary technological information in order to gain access to its market.

The large trade imbalance put consumers at risk when the cost of goods coming from China increase, and the IP transfer issues negatively impact our prized tech sector. Although not everyone agrees on an exact strategy, many politicians and economists agree that imposing tariffs may be an effective way to battle the trade imbalance with China. Due to the large trade deficit, a trade war fought via tariffs is likely to have a much bigger impact on China than it will on the US.

The trade war continues to evolve in real time, and it is difficult to predict where it will go in the weeks and months to come. The US has currently placed 25% tariffs on $200bn worth of goods imported from China and that may increase to cover more imports in the months ahead. However, taking a long-term view, both the US and China have leaders with strong incentives to see their economies grow, not stagnate. As a result, it is unlikely that the trade war continues to escalate significantly from here. At some point, we expect tensions to ease as both leaders will be looking to claim a “victory” in this dispute, although it is impossible to predict exactly when and how.

As investors, it is important to be aware of the facts and understand the impact that the tariffs will have on both economies. We expect the overall impact of this trade dispute on US corporate earnings and GDP to be minimal. Therefore, we believe that investors should stay committed to their long-term plans given the current situation and incentives for both sides.