06/01/20

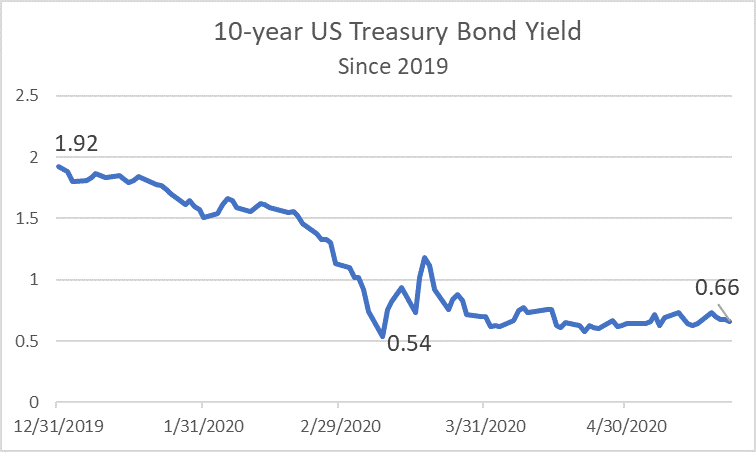

While much of our communication to date has focused on the impact of the COVID-19 virus on markets, we have also tried to highlight financial planning strategies that are more attractive when interest rates are low and equity markets have experienced a significant pull-back. Now that the S&P 500 is well off the March lows, some of those strategies dependent on depressed asset values are less compelling. However, with respect to interest rates, you may recall that the Federal Reserve had been gradually raising the Fed Funds Rate to reach a “new normal” before the virus hit. Rates have since retrenched (see chart) and the 10-year Treasury yield hit an all-time low in March of 0.54% before rebounding, slightly. The 10-year Treasury yield is now 1.26% lower than at the start of this year which a significant move given that rates were already low. It now appears that very low interest rates will be with us for the foreseeable future and this presents some opportunities to consider.

As always, please consult with your client service team to determine whether these concepts apply to your personal situation.

ESTATE PLANNING

Certain wealth transfer strategies are relevant in all environments (such as annual exclusion gifting; $15,000 limit per beneficiary) and others may make the most sense in high rate environments (Qualified Personal Residence Trust or QPRTs and Charitable Remainder Annuity Trust or CRTs). Below we highlight strategies that we believe work best in today’s low interest rate environment.

First, it is worth noting that these estate planning strategies make the most sense for those who feel they will have a taxable estate. Currently, the estate tax exemption is $11.58 million per spouse ($23.16 million per couple). That may seem like a very high number but the limit is set to revert to $5 million (inflation adjusted from 2018) in 2026, and estate tax exemptions are notoriously volatile and may be subject to higher scrutiny if we end up with a change of control in Congress. It’s a guess as to whether or not this may occur but suffice it to say that the current limits may decline at some point making these strategies applicable to a wider audience.

- Intra-family Loans. The simplest strategy entails lending to a family member at a permissible, low rate with the expectation that the assets purchased by that family member will grow at a higher rate than the loan interest. The spread between the investment return and interest rate amount to a wealth transfer free of gift tax. The minimum allowable rate is a function of the loan term and the rates are published by the IRS as the Applicable Federal Rates (AFRs). The June 2020 AFR features a 9-year rate at just 0.43% and a long term rate of 1.01% (e.g. use this for a 30-year mortgage). Loans can be structured as interest-only notes with a balloon payment on maturity.

- Grantor Retained Annuity Trust (GRAT). An irrevocable trust into which you make a one-time transfer of property, and from which you receive a fixed amount annually (annuity) for a specified number of years. If any property remains in the GRAT after the final annuity payment is made, the property will pass to beneficiaries named in the trust document free of any gift tax. Here, too, this sets up a horse race between the return earned on the investments placed in the GRAT and the interest rate used to compute the annuity but a different minimum rate applies—something referred to as the §7520 rate which is just 0.60% for June GRATS. Because these vehicles are easy and cost-effective to set-up, many choose to establish a new GRAT each year.

- Installment sale to an Intentionally Defective Grantor Trust (IDGT). This strategy builds upon both the intra-family loan and GRAT concepts presented above to provide enhanced benefits but with more technical hurdles and complexity. We will not cover the details, here, so we present this strategy as an illustration that there are options with even greater complexity and associated increased benefits available to those willing to invest the time and capital to pursue them. We can certainly help you navigate these choices.

- Charitable Lead Annuity Trust (CLAT). Similar to a GRAT, but with the annual annuity payments going to a charity of your choice. This strategy is appealing to those with both philanthropic and estate transfer goals. The §7520 rate is used to determine the annual annuity payments to charity that would be needed to assure that no gift tax is due when the annuity term is reached, and the remaining value is transferred to the ultimate beneficiaries. Like the two strategies presented above, if the investment assets grow at a rate higher than the required minimum interest rate (currently 0.60%) used for the annuity calculation, then there will be some benefit.

REFINANCING

Rates are up slightly from record lows but remain an opportunity to for those that have not yet acted. Here’s an update regarding rates, recent loan processing delays and tightening credit standards:

- Low, but not lowest. Mortgage rates reflect the trends in the mortgage bond market more than the Fed’s rate setting and those rates have declined less dramatically than, say, the 10-year Treasury Bond. Even so, rates remain highly attractive.

- Improved processing capabilities. Some borrowers were deterred from refinancing earlier this year by loan processing delays. Loan processors were initially overwhelmed and struggled to deal with a coincidental surge in applications when rates dropped as they were also suddenly forced to work from home. In addition, many third-party partners utilized by lenders (appraisers and title officers, for example) were also negatively impacted by COVID-19 because they were considered non-essential businesses in some areas of the country. This situation has generally stabilized. Some lenders have innovated to provide all-electronic loan processing, drive-by closings and no-entry home appraisals.

- Tighter lending standards. Credit conditions have tightened as lenders worry that a borrower’s financial picture may have changed in a way that is not evident on their 2019 tax return. Expect delays and requests for supplemental data to prove creditworthiness. Borrowers should be organized by having W-2’s, tax returns, and recent pay stubs accessible.

The ideas presented above highlight opportunities for achieving your financial goals that are enhanced in a low-rate environment. Because we expect low rates to be with us for some time, there may be little urgency to address these matters immediately and many of them will require further analysis to fully evaluate and deploy anyway. However, we encourage you to discuss the ideas presented above that appear to apply to your unique circumstances with your client service team.

Disclosures: This is a general discussion of current investment themes, asset classes, and specific investment segments. The discussion includes our opinions and forward looking thoughts and analysis as of May 31, 2020 and is not a guarantee of future investment results. Actual client portfolios are often customized and do not necessarily represent an exact replication of, if any, allocation discussed. This commentary focuses on a wide range of economics and finance issues in order to educate you on the linkages between these topics and their impact on the overall economy and investment markets. The content of this presentation represents the opinions of Homrich Berg regarding these educational topics and should not be interpreted as direct investment advice or marketing of HB services. Information included is from sources believed to be reliable, but which have not been independently verified. Investing involves risks including loss of principal. This document does not constitute legal, tax accounting or investment advice.