02/05/20

Each year, we typically create a list of potential concerns for the upcoming year. However, it’s common that by year-end a previously unforeseen risk or two surprises investors and the markets, such as we’re now facing with the coronavirus outbreak. It’s just a part of investing we can’t get around. It’s also one of the reasons we always find ourselves going back to the importance of a financial plan and a diversified portfolio as two essential elements to give investors and families the ability to withstand the ever-changing investment environment and to meet their financial goals, no matter the market outcome.

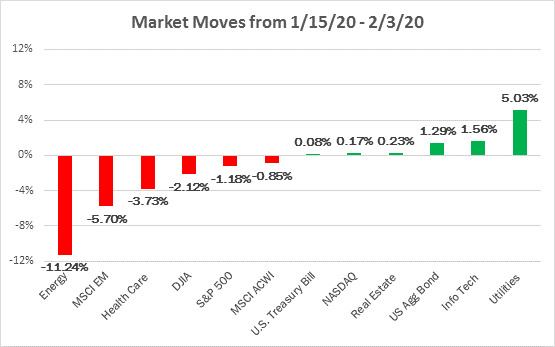

The markets began 2020 following the same general positive trends which moved the stock market to all-time highs late last year. However, the coronavirus outbreak started a not-so-unexpected modest risk-off response from investors. Some of the worst hit areas include emerging market equities, as well as airline and energy stocks. Reflecting the benefits of diversification, perceived safe-haven assets such as U.S. Treasuries, other bond sectors, as well as safe-haven equities such as utilities have had positive returns since mid-January.

The risk-off sentiment has been relatively limited, with modest pullbacks in stocks and high yield last week. The negative impact from concerns about the outbreak may have been partially offset by the positive current quarterly earnings season that so far is in line with an expected improvement in global growth this year.

Although each virus is unique, there are some similar patterns in prior outbreaks. Markets and economic data have historically responded with a V-shaped pattern. The initial temporary hit to economic growth results in pent-up demand, which eventually turns to a rebound in economic activity in sectors such as retail and manufacturing which are driven by consumer demand.

Given we are just a few weeks in, it is too soon to estimate the potential impact of the coronavirus given there are still important unknowns. These include the length and severity of the outbreak in Southeast Asia, and whether it remains largely contained. The reduced flow of people and goods due to travel restrictions and quarantine measures are likely to impact demand in the short term, hurting economic activity.

We have already begun to see a response from Chinese authorities to support the markets and growth, as we have after prior epidemics. One important difference from prior outbreaks is China’s increased role and importance in the global economy. Today, China makes up 15% of global GDP, which is three times its size during the SARS outbreak in 2003. China is now a key component of global supply chains, so it is likely we could see other disruptions with supply chains of even U.S. companies.

Overall, we still see global growth continuing to be positive this year, given accommodative central banks, the improvement in trade relations, and still mostly positive or improving economic data. The start to the latest quarterly earnings season is also a good sign. However, we recognize the recent coronavirus outbreak creates unique risks for our clients’ portfolios and we’ll be watching the developments closely as it impacts the markets and economic activity. We thank you for your continued confidence in us as we work together to meet your financial goals.

Disclosures: Chart data is for the period January 15 – February 3, 2020. Indices included in chart are S&P 500 Energy Index, MSCI Emerging Markets Index, S&P 500 Healthcare Index, Dow Jones Industrial Average Index, S&P 500 Total Return Index, MSCI All Country World Index, S&P U.S. Treasury Bill Index, S&P 500 Real Estate Index, Bloomberg Barclays Aggregate Bond Index, S&P 500 Information Technology Index, S&P 500 Utilities Index, NASDAQ Composite. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. The information reflects Homrich Berg’s views, opinions and analyses as of February 4, 2020. The information is provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any investment product. The information does not represent legal, tax, accounting or investment advice; recipients should consult their respective advisors regarding such matters. Certain of the information herein is based on third party sources believed to be reliable but which have not been independently verified. Past performance is not a guarantee or indicator of future results; inherent in any investment is the risk of loss.