05/23/2019

The Tax Cuts and Jobs Act, which took effect in 2018 was a significant tax overhaul that has impacted the way that taxpayers give to charity. The new law significantly increased the standard deduction, which can reduce or even eliminate the tax benefit that some taxpayers get from annual donations to charity. Many taxpayers won’t collect the necessary deductions to surpass the new standard deduction threshold. And the elimination or reduction of many popular deductions may put itemization out of reach entirely.

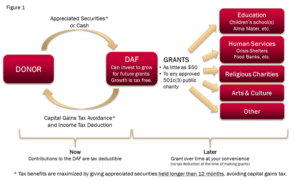

One way to overcome this issue involves the use of a charitable vehicle called a Donor Advised Fund (DAF). DAFs have been around for many years, but they are now an even more valuable tool for many charitably minded taxpayers. Donors with DAFs can use a strategy called “bunching,” in which they fund a DAF with multiple years’ worth of charitable gifts in a single year in order to surpass the itemization threshold, and distribute cash to charities from the DAF over time. Some donors will only itemize deductions in the “bunching” years, and take the standard deduction in off-years (or “skip-years”). Bunching can also be beneficial if a donor has a year with abnormally high income (e.g. from the sale of a large asset or payout of a large bonus). Funding several years’ worth of charitable gifts in the high-income year will maximize tax benefits.

What is a DAF?

A DAF is a charitable account that allows a donor to:

1) “Pre-fund” future charitable gifts when it is advantageous for the donor, and

2) Make large or small grants to charities of the donor’s choice over any period of time. Any amount not granted right away can be invested and will grow tax-free.

The donor receives a charitable deduction for making contributions to the DAF account. This is generally done with appreciates securities when possible, but the account can be funded with cash or other assets as well. The donor can then make grants to virtually any 501(c)(3) IRS-qualified public charity – that means everything from the donor’s alma mater to the local church. Donors can even support international causes through a DAF.

How a DAF Works

A DAF is technically an account at a public charity that enters into an agreement with a donor. The agreement gives the donor the right to advise the fund on how the donor’s contributions will be invested and how grants to charities will be made. Because the DAF is technically an account at a public charity, contributions to the DAF are irrevocable, and qualify the donor for an immediate tax deduction (subject to the same Adjusted Gross Income limitations as other public charities).

Donors decide on their own fund name (e.g. The Jones Family Fund) and who will have authority to request grants from the account. During life, the donor (or the donor’s designee) can make ongoing, non-binding recommendations to the fund as to how much, when, and to which charities grants from the fund should be made. Additionally, the donor can advise on how contributions should be invested. The donor may suggest that, upon death, grants be made to charities named in his or her will, or the donor may designate a surviving family member(s) to recommend grants.

In order for gifts to a DAF to qualify for a charitable deduction, the gift must be irrevocable and technically the charity that holds the DAF account is not obligated to follow any of the donor’s suggestions — hence the name “donor-advised fund.” As a practical matter, though, the fund will generally follow a donor’s wishes.

See Figure 1 for an illustration of how DAFs work.

Some Additional Advantages of DAFs

Using a DAF to “pre-fund” future charitable gifts can have several advantages, including:

- Simplified process for making multiple gifts – For example, if a donor has appreciated stock worth $5,000 and would like to make gifts of $500 each to 10 charities, paperwork is only needed once to transfer the stock to the DAF, and there is only one charitable gift to report for tax purposes. Grants can easily be processed online from the DAF to the desired charities.

- Anonymity – Grants from DAFs are typically identified as being made from a specific donor’s account, but they can be made anonymously at the donor’s request.

- Expert advice – Many charities that offer DAF accounts offer expert advice on grantmaking.

How to Establish a DAF

Donors can open a DAF at several organizations. Below are some common examples:

- National low-cost options include:

- Fidelity Charitable – a separate charitable entity affiliated with Fidelity Investments

- Schwab Charitable – a separate charitable entity affiliated with Charles Schwab

- Local community foundations – Usually community foundations will have specific expertise in local community needs and the charities established to meet those needs. Often they will provide additional support in connecting donors to charities in the community. Community foundations often charge higher fees than the national organizations in order to support these additional services. The Community Foundation for Greater Atlanta is an example. Many other large cities have similar organizations.

- National and local religious charities – Like Community Foundations, religious charities have specific expertise in charities that support their religious philosophy or affiliation. Examples include:

- National Christian Foundation

- Jewish Federation of Greater Atlanta (or other local affiliates in various cities)

Other Important Details

There are fees associated with establishing and/or maintaining DAFs. Large national organizations generally charge between 0.10% and 0.60% of assets in the account, depending on the balance. Other administrative fees may also apply, though these are generally small. Charities that offer significant additional services such as community foundations and religiously affiliated organizations generally charge more. However, many donors view these higher fees as an additional charitable donation to help support causes they care about. There are also management fees charged for underlying investments that can vary significantly. With large enough account balances, HB can manage the account, which may enable you to choose investments with lower fees than the investment options for smaller accounts.

Some DAFs can accept non-cash assets other than securities, such as real estate, private alternative investments, or certain complex assets such as privately held company stock. Not all DAFs are equal in this regard, so you will want to plan ahead and work with your HB advisor if you plan to fund a DAF with non-cash assets other than publicly traded securities.